Wherever you are in your financial journey, you deserve the best financial advice: it will make all the difference.

A financial plan is a comprehensive evaluation of your current and possible future financial state.

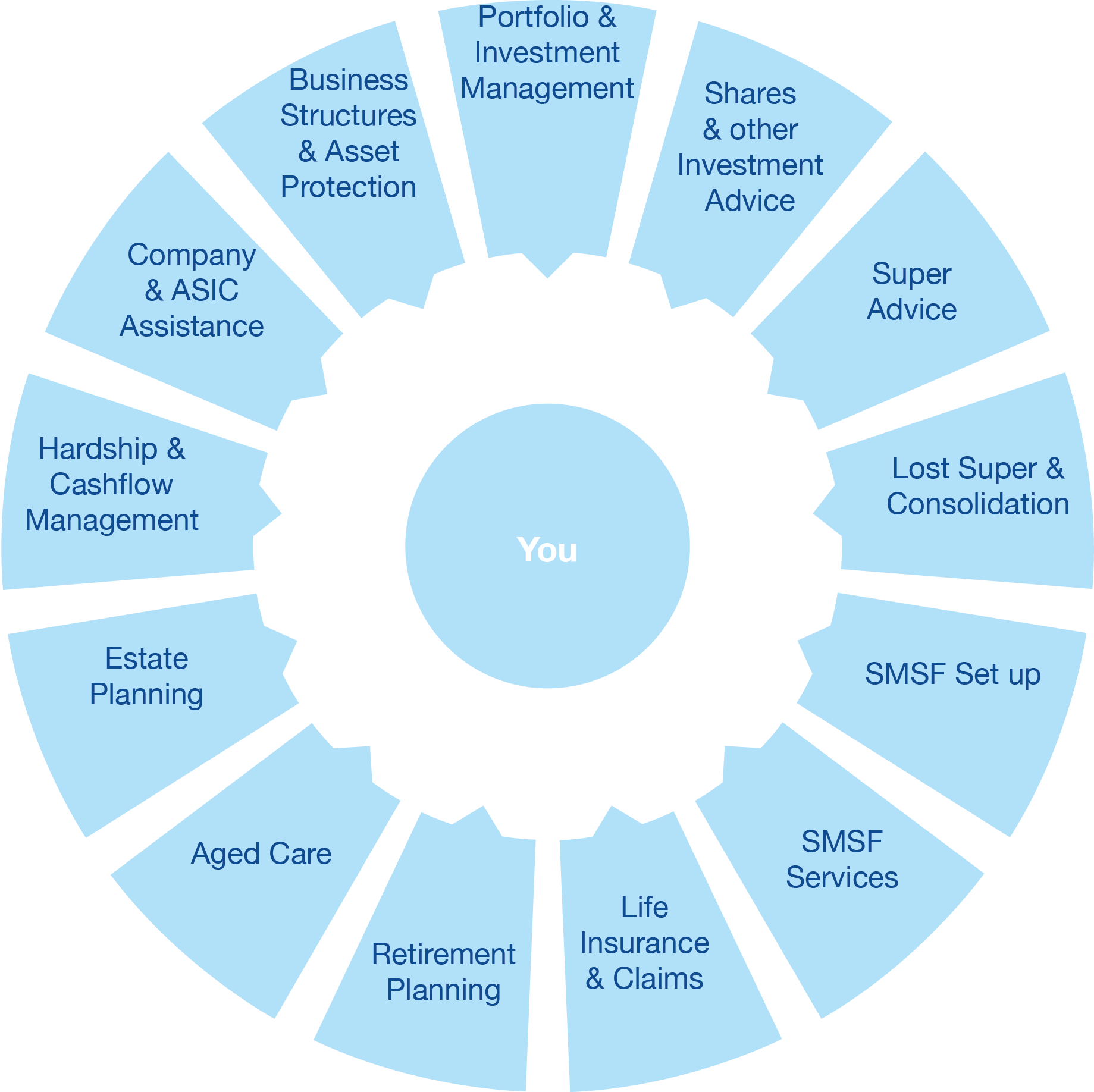

We work with you to ensure the right framework or strategy is in place for you, by starting with “Where are you now?” before moving onto “Where do you want to be in the future?”. This is achieved via sound strategic planning, investment recommendations, portfolio management, stockbroking, superannuation, estate planning, tax implications, as well as personal insurance advice.

It all begins with financial goals. What do you want to achieve?

Your ultimate financial goals will significantly impact your ultimate lifestyle ambitions.

What is Financial Planning?

Its an overall financial health check.

This is achieved via sound strategic plan that includes:

- Where you are now;

- Where you want to be in the future given your risk profile;

- How to build Assets and other Investment Advice;

- Investment recommendations, portfolio management and stockbroking;

- Superannuation and Personal Insurance;

- Retirement lifestyle and income; and

- How you want your assets disposed of when you pass away.

Upon retirement, your greatest asset may be your superannuation rather than your family home.

It all begins with financial goals. What do you want to achieve?

Our Approach

Wherever you are in your financial journey, you deserve the best financial advice: it will make all the difference.

We offer an exclusive client experience. We know that every client is different so we don’t adopt a one-size-fits-all approach. We work with you to help you recognise your true intent, your goals, aspirations and all the factors that might hinder those outcomes.

We provide advice to help you protect you and your family and plan for your future.

We know that one of the keys to success is flexibility as you move through the stages of life. We will regularly meet with you to update you and help make any variations if your personal circumstances change.

We’re different, and that makes all the difference.

Click below to see how we can help you

Portfolio & Investment Management Service and Advice

Shares & Other Investment Advice

Super Advice

Super Consolidation and Lost Super Assistance

Self Managed Super Fund (SMSF) Set Up

SMSF Administration Services

Life Insurance Advice and Claims Assistance

Retirement Advice and Planning

Aged Care and CentreLink Services

Estate Planning and Death Benefits

Financial Hardship and Cashflow Management

Company Maintenance and ASIC Assistance

Business Structural Advice and Asset Protection

Frequently Asked Questions

Company Maintenance and ASIC Assistance

What is a Registered Office Address?

An Australian company must have a registered office to that is open during business hours. A Registered Office must receive correspondence and does not need to be the same as the company’s principal place of business, but it cannot be a post office box.

What is an ASIC Registered Agent?

An ASIC Registered Agent facilitates and streamlines submission of documents for lodgement to the registers maintained by ASIC and the receipt of notifications from ASIC about the annual review obligations of registered Australian companies. An ASIC registered agent is the person that is authorised by registered Australian companies to submit documents to ASIC, may receive notifications on behalf of the company and may provide other administrative services to businesses.

Life Insurance Advice and Claims Assistance

What is Income Protection?

Income protection replaces the income lost through your inability to work due to injury or sickness. There is generally a waiting period of between 15- 60 days on this insurance, depending on the level of cover and premiums paid. Income protection will only cover a maximum of 75% of your gross income for a maximum period of 2 years.

What is Trauma Cover?

Trauma provides cover if you are diagnosed with a specified illness or injury. These policies include the major illnesses or injuries that will make a significant impact on your life, such as cancer or a stroke. It is also referred to as ‘critical illness over’ or ‘recovery insurance’.

What is Total and Permanent Disability Cover (TPD)?

TPD pays a lump sum to assist with rehabilitation costs, debt repayments and future living costs if you are totally and permanently disabled. TPD is often bundled with life cover. It is important to note that TPD is usually offered in 2 definitions, ‘own’ or ‘any’. TPD ‘own’ means that you cannot work again in your usual or own occupation. TPD ‘any’ means that you cannot work in any occupation. For this reason, TPD ‘own’ cover is more expensive.

What is life / death cover?

Also known as ‘term life’ or ‘death cover’, life cover as the name suggests, pays a set amount of money when you die. This money will go to the people you nominate as beneficiaries on your policy.