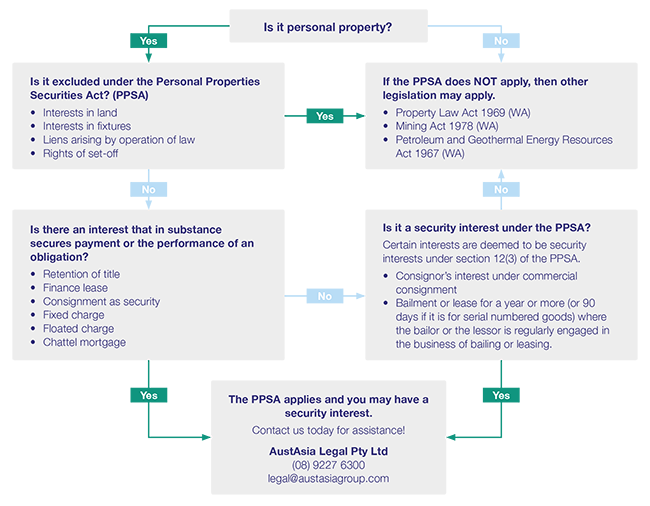

Do you have an ownership interest in an asset which is in possession of a third party? For example do you hire your machinery for use by others? Do you supply material on a retention of title basis? Do you provide goods under a contract with a deferred payment? If so then you may have a security interest in that property. If you do not register the interest on the Personal Properties Security Register and the third party becomes bankrupt or is put into liquidation you may lose you rights to the goods, which you have an ownership interest in.

Click here to download this article in PDF format.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Legal Pty Ltd (ACN 123 160 476).

AustAsia Legal Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

Information in this publication is accurate as at the date of writing, 12 June 2017. Some of the information has been provided to us by third parties. Whilst it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.