Thank you for engaging with AustAsia Accounting Services Pty Ltd. The next step is to invite us to become your Xero Adviser.

As a Xero Certified Advisor and Partner we are fully qualified to manage all of your book keeping, tax and business processes. This saves time, reduces errors and lowers overall costs.

As your Xero Adviser we will:

- Review your financials in real time, managing the growth of your business and/or investments

- Ensure your Xero information and settings are in order

- Ensure your business and/or investments adhere to all compliance requirements

Inviting us to become your Xero advisor is easy. Simply follow the five steps outlined below.

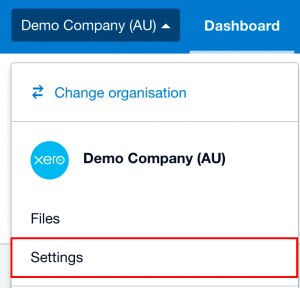

1. In your Xero file, click on your Xero entity name on the top right of the menu bar, and select Settings from the dropdown menu.

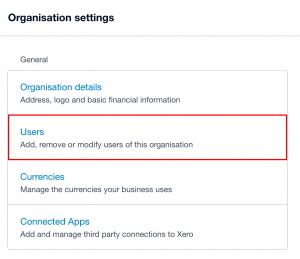

2. In the Organisation Settings menu, select Users.

3. In the Users menu, select Invite a user.

![]()

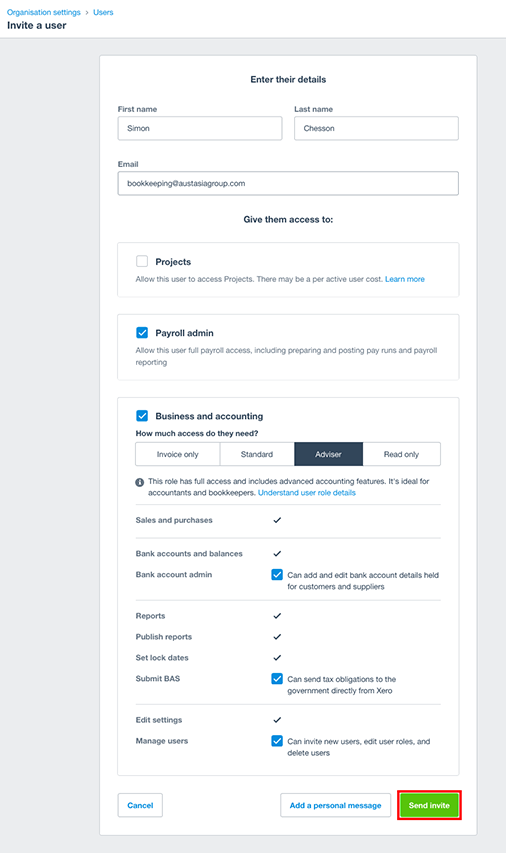

4. In the Invite a User menu, please enter the details below in the corresponding fields:

- First Name: Simon

- Last Name: Chesson

- Email: bookkeeping@ww2.austasiagroup.com

- Please tick Payroll Admin (this allows us to assist you with any payroll related matters)

- Please tick Business and accounting, and select Adviser, then tick the following checkbox below.

- a. Bank account admin (this allows us to add and edit bank account details for customers and suppliers depending on your Xero subscription, and services required from AustAsia Accounting Services Pty Ltd).

- b. Manage users (this allows us to manage our practice staff access).

- Then, click Send invite.

Click here to download this article in PDF format.

If you require any assistance, please don’t hesitate to ask to contact the AAG team on (08) 9227 6300 or email clientservices@ww2.austasiagroup.com. We’re here to help.

Important information and disclaimer

This publication has been prepared by AustAsia Group, including AustAsia Accounting Services Pty Ltd (Registered Tax Agent No 7587 3005).

AustAsia Accounting Services Pty Ltd – Liability limited by a scheme approved under Professional Standards Legislation.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal advice prior to acting on this information.

Information in this publication is accurate as at the date of writing, 7 November 2018. Some of the information has been provided to us by third parties. Whilst it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor any member of AustAsia Group, nor their employees or directors give any warranty of accuracy, nor accept any responsibility, for any errors or omissions in this document.

Any general tax information provided in this publication is intended as a guide only and is based on our general understanding of taxation laws. It is not intended to be a substitute for specialised taxation advice or an assessment of your liabilities, obligations or claim entitlements that arise, or could arise, under taxation law, and we recommend you consult with a registered tax agent.